Last week, erable° was subjected to a profoundly unfair media lawsuit, which appeared to be orchestrated over time and included many false accusations. We aim to clarify the facts and address the concerns that were raised.

The campaign, involving an ex-partner and characterized by baseless legal threats, trolling, and media attacks, demonstrates extreme hostility.

We also profoundly understand the disappointment experienced by our token's decline in value over the past two years. Naturally, we have always warned of the risks of volatility inherent to such a young project. Our unwavering commitment remains: token valuation is a daily priority, and we're keeping the migration date for the end of Q2 2024. Register now for the dedicated AMA on token migration happening on February 29 at 1 PM CET.

Our team is fully dedicated to making erable° a success. Despite challenges and harsh criticisms, we believe we'll overcome these obstacles and emerge stronger. With a clear roadmap, we're confident in achieving our ambitions and leading this project to success.

Sincerely, the erable° Executive Team

Cardashift Initial Coin Offering (ICO)

What were the key stages of this ICO?

This ICO unfolded in three stages:

- Private Sale (October 2021 - founders, friends & family)

Token count and price are detailed in our White Paper, p32. The sale was conducted in exchange for a post-ICO lock-up (50% for 6 months, 50% for a year).

The private sale, partially through founders and their close network (also named “friends & family”), validated our value proposition's appeal and financed the ICO's execution and launchpad start. Public sale investors had full access to this sale's details through extensive communications and the ICO's terms and conditions.

- Public Sale (January 2022 - open to everyone)

The public sale was the ICO's main phase where investors could directly invest and receive their tokens. Conditions, rules, and various clauses were detailed in the White Paper on p33 and in the ICO's terms and conditions. Shortly afterward, the token became available on Cardano's decentralized exchanges, thanks to the liquidity we provided from the start.

- Other token allocations (from September 2022)

Communication operations and liquidity contributions were funded with $CLAP tokens as outlined in the White Paper on p32. The treasury holds 509M $CLAP tokens. The team has not accessed any tokens, extending the vesting period and linking the release of vesting tranches to specific objectives. No tokens have ever been sold by Cardashift.

How much did Cardashift raise in its ICO?

Between September 2021 and January 2022, Cardashift raised 5M ADA and $2.2M. Due to the fluctuating exchange rate during the ICO phases, the founding team used a rate of $1.26 from the White Paper's publication to set the ICO's official amount at $8.5M.

Market volatility and the expectation of investment promise validations led the marketing/growth direction at the time to announce an ICO amount of $10M in the Medium post.

Why do erable°'s financial statements report revenues of just €5 million in 2022?

The accounting and tax practice for an ICO in France, approved by our tax advisors and the authorities prior to the ICO, involves spreading the raised amount over several years of development roadmap.

The €5,119,986 reported as revenue for the fiscal year from 09/01/2021 to 12/31/2022 represents only a portion of the ICO. The remainder is recorded as deferred revenue (PCA in French) and will be recognized as revenue in the 2023 and 2024 financial statements.

What happened to the funds raised?

Reminder: Between September 2021 and January 2022, Cardashift raised 5M ADA and $2.2M.

The ADA collected during the ICO were sold gradually over two years in a bearish market, averaging $0.52 per sale, marking a significant drop and a total devaluation of $3.7M from the White Paper rate, thus reducing the initial $8.5M to $4.8M.

The investments thereafter are categorized into two periods: Cardashift (September 2021 to February 2023) and erable° (since March 2023).

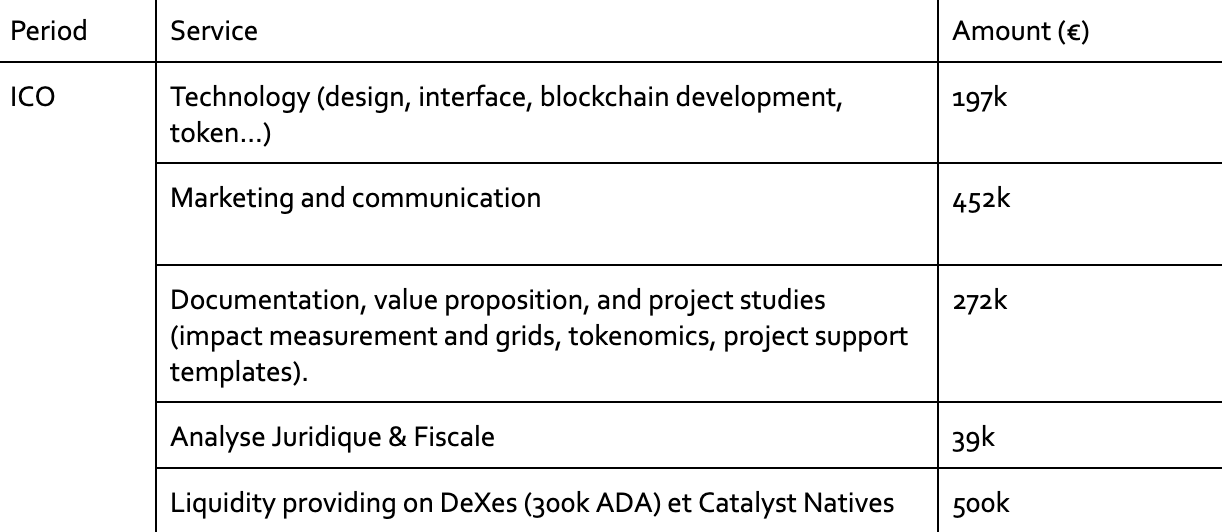

Cardashift epoch

During the first 18 months (the Cardashift period), €2.9 million was invested through service provisions and staff made available by external entities, as SMARTIMPACT had no direct employees.

This phase aimed to launch a project with a unique ambition, gathering a community around this vision. Key efforts included developing the launch platform, spreading the project's message, and elaborating the value proposition alongside relevant documentation.

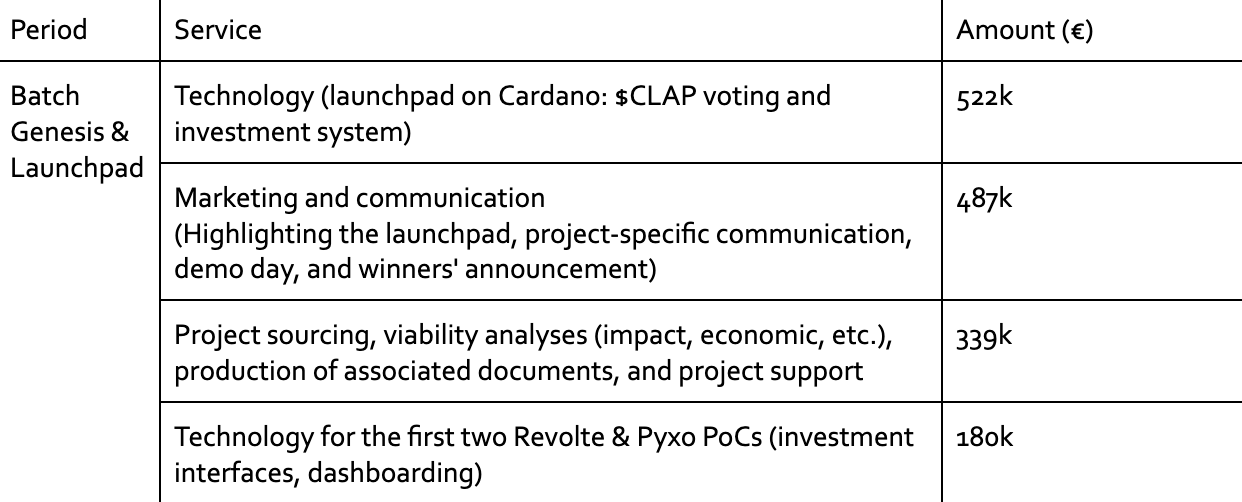

The subsequent phase, encompassing the Genesis Batch and Launchpad, focused on solidifying the initial ambition by identifying, recruiting, and showcasing a range of projects that embody the social and environmental objectives, all hosted on a platform developed specifically within the Cardano ecosystem.

A number of service providers were involved.

- For product & technology: SmartChain, a company under NDA, MLabs and LittleBigSmala

- For marketing & communication: Ingenuity, Splashr, Sense4All, Vivatech, SmartChain and freelancers.

- Documentation, sourcing and support: Stim, a company under NDA, SmartChain and freelancers

- On the legal side: the law firms FieldFisher and Lafont-Dugal & Associés

Radical changes since the switch to erable°

In March 2023, as Cardashift transitioned to erable°, the current leadership team took over, beginning the process of gradually bringing operations in-house. This shift marked a significant change in governance and management, significantly reducing development costs (for platforms funding tangible assets on Polygon, issuing digital asset collections and dashboards, white-label solutions, etc.).

Throughout the rest of 2023, operational costs have been minimized as follows:

- payroll under €30K/month,

- external technical services at €11K/month (reducing to €5K from 2024),

- and other overheads below €5K/month (offices, legal, tooling, …)

Today, the company has a gender-balanced team of 9 employees and a strong financial standing, ensuring operation for over eighteen months. While some technical services are still outsourced, the goal is to internalize them in 2024. It's also noted that revenue (excluding ICO) significantly increased in the second half of 2023.

Launchpad / Batch Genesis

How did the Batch Genesis preparation go?

The genesis batch began with sourcing and evaluating 250 projects, resulting in a shortlist of 10 projects known as the "Batch Genesis."

Through decentralized voting by CLAP holders, enabled by the launchpad platform, the community qualified 4 projects (Aquaverse, Carboneo, Revolte, Pyxo), with 2 selected for funding: Revolte and Pyxo.

Thus, Revolte and Pyxo are supported in developing their token financing model.

Finally, we published our learnings from the first batch of project sourcing transparently.

What platform has been developed for this purpose?

The launchpad.cardashift.com platform was designed to facilitate voting on 10 genesis batch projects, incorporating specified voting rules.

Besides voting, it supports end-to-end fundraising management (IDO), including whitelisting, managing different investment phases (similar to the Cardashift ICO), and handling token vesting and claims.

The platform is built on Cardano, and the fundraising system is 90% developed. Development has been put on hold for the move to Polygon and the deployment of our first two PoCs: Revolte and Pyxo.

How did the community voting phase go?

In 2022, the selection of projects by Cardashift/Erable was subject to a vote, with voting rights initially granted to CLAP token holders as specified in the regulations.

Private sale purchasers, including founding members, were initially excluded from voting due to their tokens being locked. To avoid unjust “technical” exclusion from voting, voting tickets corresponding to the number of locked tokens held were generated, allowing their use in voting on the platform equally with new investors.

The private investors, being early members of the Cardashift journey, were rightfully included in the voting process.

The community vote on the Genesis batch aimed to pre-select projects based on two criteria - +10% volume of voting tickets and +10% number of unique voters - with the Cardashift team reserving the right to select winners to ensure viability before community funding.

Based on the criteria and process, Cardashift chose to support two as the first PoCs.

Moreover, we designed a voting model to balance the influence of major holders detailed. Learn more here.

Token & Migration

What are $CLAP utilities?

- Q2 2022: Voting during the genesis project batch on the launchpad.

- Q4 2022: Investing in $CLAP in launchpad projects

Exclusively for Revolte but halted due to $CLAP price devaluation and blockchain change.

Post-DAO deployment on EVM via tools like Snapshot, token holders will be able to choose to activate $CLAP investment in the app for specific projects.

- Q4 2022 - Present: Voting for DAO investment in a launchpad project.

EVM Treasury - 0x5484b93718dd5bcb2892610bfc789adf7680563d

Cardano Treasury - addr1q8j3e5t402xzutacpu22wuw7d8g366wapqg29sfejrtsna9cjxt7rq9rfwqqh3wv24adfv2hex0ttwu3zh7e276xmcesgdlnhj

- Future token utilities are detailed in the section "What will be the token's future utilities?"

Is $CLAP still available and liquid?

This token is readily available and (has always been) tradeable on Cardano's decentralized exchanges, such as Muesliswap or Wingriders.

Consistent with its White Paper, Cardashift contributed liquidity to several DeX platforms on Cardano in 2022 and has never withdrawn this liquidity. Liquidity for CLAP varies across decentralized exchanges, with the price being 1 ADA for 411 CLAPs as of the writing date (02/06/2024).

Why the migration and what timeline?

To provide context, we recommend reading our article "Cardashift becomes erable°" published in Q2 2023, which explains the launch of our app on Polygon (EVM).

The migration of the $CLAP token aims to connect it to our app (and our tech ecosystem) on Polygon (EVM), access users and liquidity in the EVM economy (Ethereum, Polygon, and other L2), strategically position in the ReFi ecosystem for increased adoption and collaboration opportunities, and optimize development costs for our apps and interactions with the token.

We plan to initiate the migration in the second quarter of 2024.

Register now for the AMA dedicated to the token migration, to be held on February 29 at 1pm CET.

Contact us at: token@erable.com

What will be the token's future utilities?

The token structure supports era°dao's goal of ensuring the sustainability of its activities and community management.

It is viewed as a means to aggregate value created within the erable° ecosystem, serving as a versatile tool to facilitate individual engagement, fund allocation, and the distribution of rewards within the erable° community.

- As a store of value: a stake in the future value of erable° network. The more you stake over a long period, the more you’re incentivized over the success of the network.

- As a medium of exchange:

can be used to access erable° ecosystem perks & memberships

can be earned by interacting within e° ecosystem of apps

will be tradable on DeX - CeX*

- As a unit of governance: participation in decisions concerning era°dao and app settings.

Register now for the AMA dedicated to the token migration, to be held on February 29 at 1pm CET.

Contact us at: token@erable.com

erable°

Why the rebranding from Cardashift to erable°?

The rebranding from Cardashift to erable° in March 2023 marked a shift in governance, aiming to present a brand more accessible to the general public and less confined to tech, moving away from Cardano-centric terminology towards development on Polygon (EVM) - see blog post.

The story behind our new name :

- “era” serves as the foundation of our mission — it embodies the “why” behind our vision to facilitate a transition toward a sustainable & desirable future: usher in a new era.

- “able” reflects our approach to making this vision a reality — the “how.” Our aim is to empower everyone to actively participate in this transition through investment, rather than merely observing from the sidelines.

What services does erable° provide?

As of now, erable° offers three types of services. Beyond its business model, this diversification allows erable° to broaden its impact potential by accommodating the needs of various client types, including start-ups, intermediaries, or large accounts.

#1 - Project Financing on the App (app.erable.com): Involves a fixed fee plus a success fee on the amount raised and on returns paid into the treasury, aligning interests with investors.

Example clients include HomeCycle and Revolte.

#2 - Platform Licensing as-a-Service: Consists of a setup fee and monthly licensing, with optional add-ons like specific development or product management.

Example clients are pyxo.erable.com and invest.keenest.co.

#3 - Analysis & Modeling Before Platform Launch: Offers advisory fees. This model enhances erable°'s expertise in meeting the needs of larger clients and improving its product offering accordingly.

Example clients include three under NDA, among them a leading European road transport company.

What are the top priorities for 2024?

2024 will be a busy year for erable°, as highlighted in our latest semestrial update.

- Acceleration of the number of projects on the platform: 1 project / month

New verticals will be highlighted, such as water recycling, second-hand and sustainable packaging. Average fundraising amounts will also rise to €100K.

- Launch of an investor club

By calling on expert profiles in the subjects covered, the aim is to professionalize the investors and ensure that their knowledge benefits the whole community.

- Other distribution partnerships or external growth (confidential)

This approach will accelerate the development of the erable° ecosystem, while enriching the offering through the expertise and know-how of these new partners.

- Re-launch of the token on Polygon in June 2024 (see above)

This will be the culmination of a busy six-month period aimed at launching the future token in a more complete ecosystem, able to offer valuation mechanisms.

- Offer diversification and new regulatory approvals

As our platform develops, we'd like to offer other forms of investment that require specific approval (PSFP - European Crowdfunding Service Provider).

- Protocol: Bridging the gap between DeFi & ReFi/RWA

Allowing anyone to gain exposure to the best of DeFi lending while gaining exposure to a portfolio of tangible assets for the ecological transition. All while remaining liquid.

Our reputation has undoubtedly been tarnished and damaged, yet this media action has not shaken our convictions. Erable and all its teams, founders, and partners reaffirm their unwavering long-term commitment to this project.

We have a duty to succeed, which will be our ultimate response to the allegations!

.jpg)